sales tax calculator buffalo ny

The Erie County Sales Tax is collected by the merchant on all qualifying sales made within Erie County. However all counties collect additional surcharges on top of that 4 rate.

How To Charge Your Customers The Correct Sales Tax Rates

County lawmakers passed a measure to cap the county sales tax on gas at 3 a.

. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254 on top of the state tax. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

2022 Final Assessment Roll. Groceries are exempt from the Erie County and New York state sales taxes. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Buffalo sales tax rate is. At 4 New Yorks sales tax rate is one of the highest in the country. Fast Easy Tax Solutions.

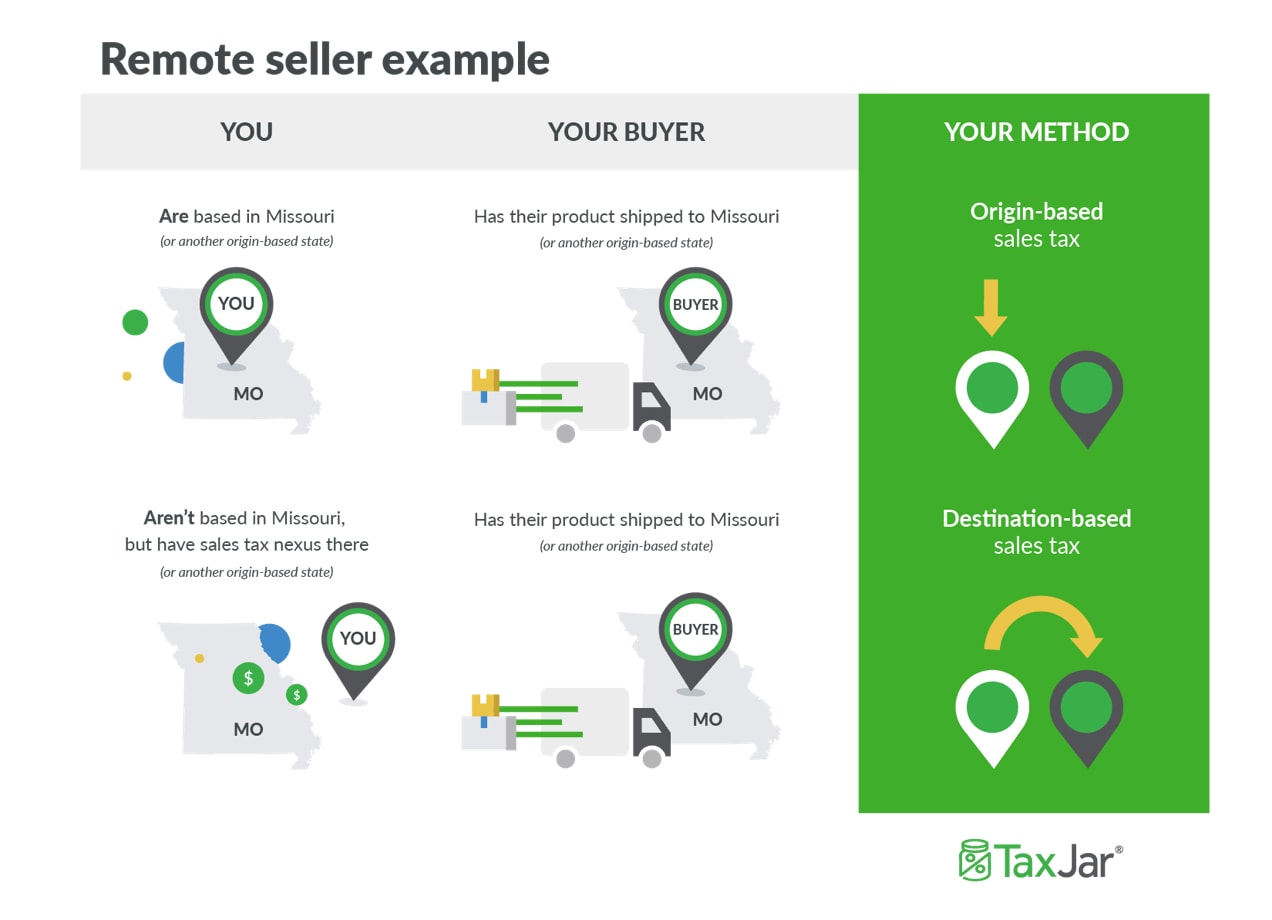

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts. New York NY Sales Tax Rates by City A The state sales tax rate in New York is 4000. If you leased the vehicle see register a leased vehicle.

The Sales tax rates may differ depending on the type of purchase. The New York sales tax rate is currently. This means that depending on where you are actual rates may be significantly higher than other parts of the country.

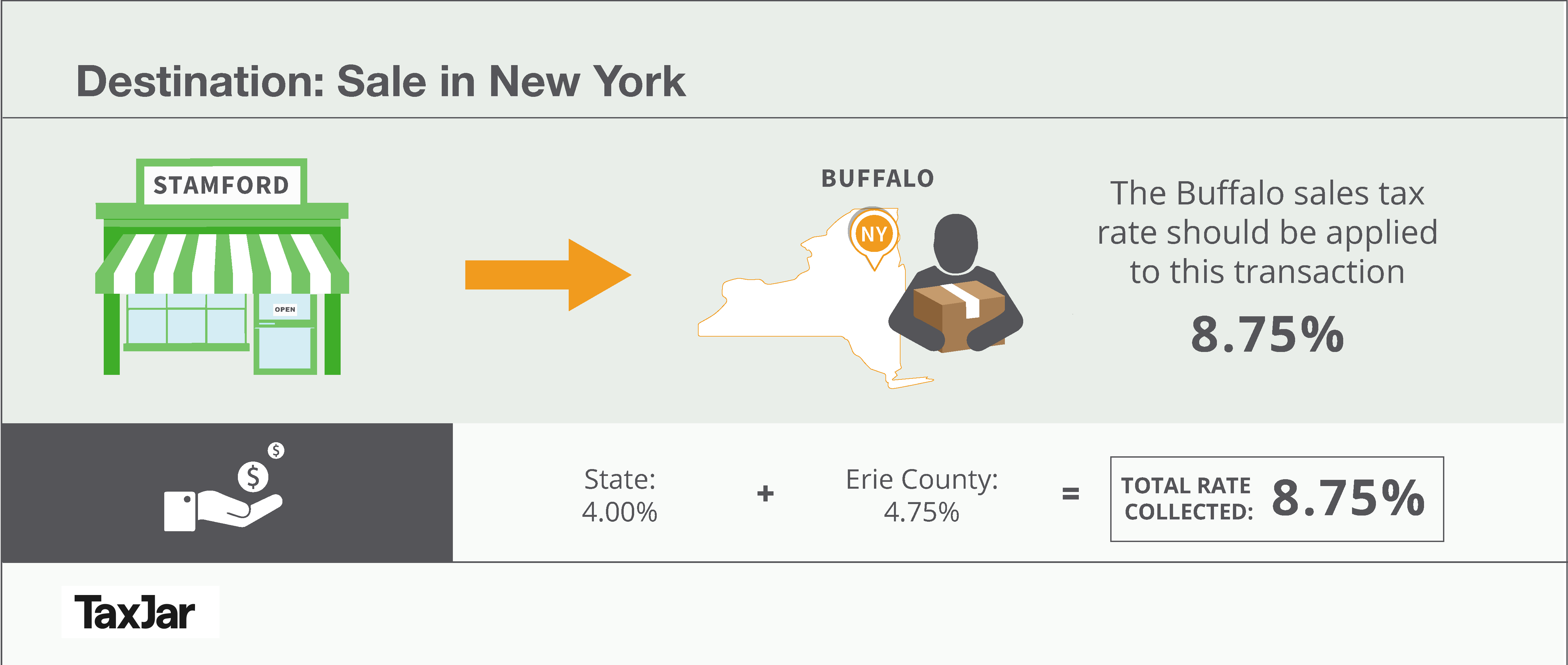

This is the total of state county and city sales tax rates. This means that depending on your location within New York the total tax you pay can be significantly higher than the 4 state sales tax. The minimum combined 2022 sales tax rate for Buffalo New York is.

Subscribe to Sales tax to receive emails as we issue guidance. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. You can print a 875 sales tax table here.

Select the New York city from the list of cities starting with A below to see its current sales tax rate. If the vehicle was a gift or was purchased from a family member use the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and Finance DTF-802 to receive a sales tax exemption. The Erie County New York sales tax is 875 consisting of 400 New York state sales tax and 475 Erie County local sales taxesThe local sales tax consists of a 475 county sales tax.

Method to calculate Buffalo sales tax in 2021. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax. In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5.

With local taxes the total sales tax rate is between 4000 and 8875. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Buffalo NY. 0125 lower than the maximum sales tax in NY.

The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022. The table below shows the total state and local sales tax rates for all New York counties. Sales tax applies to retail sales of certain tangible personal property and services.

There is no applicable city tax or special tax. The County sales tax rate is. The Department issues the appropriate annual tax bill predicated on the final assessed value.

An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. WIVB Drivers in Niagara County will soon have more relief at the gas pump. Apr 25 2022 0617 PM EDT.

The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. New York has recent rate changes Sun Sep 01 2019. The DMV calculates and collects the sales tax and issues a sales tax receipt.

For tax rates in other cities see New York sales taxes by city and county. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Ad Find Out Sales Tax Rates For Free.

Minnesota Sales Tax Calculator Reverse Sales Dremployee

Tax Efficient Investing In Gold

How To Charge Your Customers The Correct Sales Tax Rates

New York Vehicle Sales Tax Fees Calculator

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

How Taxes Affect Nhl Salaries Stats And Stuff

Which States Require Sales Tax On Clothing Taxjar

New York Vehicle Sales Tax Fees Calculator

Amazon And Third Party Sellers A Due Process Bar To Sales Tax

New York Property Tax Calculator Smartasset

Online Sales Tax Compliance Ecommerce Guide For 2022

How To Charge Your Customers The Correct Sales Tax Rates

Niagara Falls Property Tax 2021 Calculator Rates Wowa Ca

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

New York Sales Tax Guide And Calculator 2022 Taxjar

New York Property Tax Calculator 2020 Empire Center For Public Policy

How To Charge Your Customers The Correct Sales Tax Rates

South Dakota Taxes Sd State Income Tax Calculator Community Tax

South Dakota Taxes Sd State Income Tax Calculator Community Tax